Regional Business Models of Battery Recycling: Economics, Strategies, and Technological Trends

Regional Business Models of Battery Recycling: Economics, Strategies, and Technological Trends

Chaitali Agale, Dr. Mark Strauss, Malene Fumany

About Battery Associates: Battery Associates (B.A) is an impact-led company working towards sustainable battery innovation through the power of people. This is a multidisciplinary approach to solving battery challenges for the battery sector. This article is a short summary of our upcoming Recycling Whitepaper written by Battery Associates Ambassadors in collaboration with Battery Associates.

Introduction

The global transition towards net zero emissions has spotlighted the significance of batteries, particularly in the context of electric vehicles (EVs) and stationary storage. As the demand for batteries rises, so does the need for sustainable practices in their production, utilisation, and end-of-life management. This article explores the European regional business models of battery recycling. The analysis includes prominent automotive manufacturers such as Volkswagen (VW), Daimler, BMW, and Tesla, offering insights into their current business models, and recycling processes.

European Region: OEMs Approach to Recycling

In Europe, the battery recycling ecosystem is undergoing rapid evolution, primarily driven by stringent regulations and the pursuit of a self-sufficient and vertically integrated battery market. Major Original Equipment Manufacturers (OEMs) in Europe have adopted various strategies for battery recycling:

- **Volkswagen** (VW): VW has embraced a spoke-and-hub approach, establishing an in-house hub with processing capacity in Salzgitter. Additionally, VW has partnered with Northvolt, employing a hydrometallurgy process for recycling.

- **Daimler: ** Similar to VW, Daimler is moving towards full vertical integration, with the groundbreaking and scale-up of the recycling project in Kuppenheim in 2023. The initial facility is solely mechanical shredding, and the hydromet facility will arrive at an unstated later date.

- **BMW: ** BMW has laid out a comprehensive plan for carbon neutrality in its car supply chain, focusing on circularity with a 4R approach: RE: THINK, RE: DUCE, RE: USE, RE: CYCLE. The company aims for up to 95% recyclability in its vehicles and is investing in research and development, such as the Parsdorf plant. The timeline, goals and capacity for this facility are unknown.

- **Tesla: ** Tesla, with its early adoption of vertical integration, primarily recycles batteries in-house, avoiding landfill disposal. The company strives to extend battery life through software updates and recycles all end-of-life batteries. For example, in its US facilities, Tesla will have separate but interwoven recycling facilities outside Reno, NV connecting to the pyro hydro facility in Austin.

The European region showcases a diverse range of approaches, emphasising the need for control over the supply chain and compliance with recycling regulations.

Advantages and Disadvantages of Vertical Integration

Vertical integration offers advantages such as control over the supply chain, reduced dependence on external factors, and competitive advantages in meeting recycling content regulations. However, it comes with challenges, including significant capital investment, complex management structures, and potential difficulties in adapting to market changes.

In the coming years, challenges are anticipated, such as limited availability of recycled materials, increased costs for OEMs that are not vertically integrated, and potential green premiums in metal prices. The fluctuating prices of recycled materials and uncertainties regarding the price comparison with virgin materials pose significant challenges.

Regional Recycling Policy

Each region has distinct recycling policies that impact OEMs and recycling facilities. The European region, driven by stringent regulations, encourages OEMs to adopt advanced recycling practices. In North America, the regulatory landscape may vary between the USA and Canada, influencing OEM strategies. In Asia, particularly in China, Korea, and Japan, policies focus on supporting the rapid growth of the EV market.

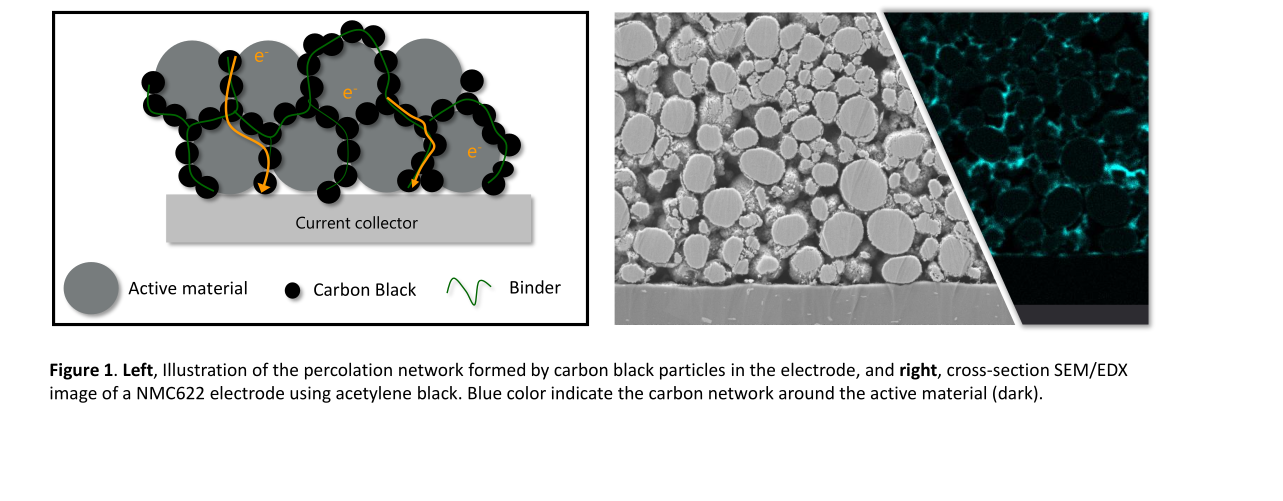

Techno-Economic Factories of Different Recycling Technologies

- Hydrometallurgy: Hydrometallurgical processes involve the leaching, separation, and purification of battery metals using reagents. Companies like Northvolt, RecycLiCo, Li Cycle, and Neometals follow hydrometallurgical routes. The process typically includes leaching black mass, removing impurities, and separating nickel, cobalt, and manganese through solvent extraction.

- Pyrometallurgy: Pyrometallurgical operations, such as those at the Umicore Hoboken facility, use high-temperature reduction smelting to recover metals from batteries. The process involves fluoride volatilisation, slagging Mn/Al/Fe, and forming a metal alloy phase, which undergoes further hydrometallurgical refining to produce nickel, cobalt, and copper products.

- Direct Recycling: Direct recycling aims to rejuvenate end-of-life cathodes by roasting them with lithium salts. However, challenges include discrete cathode recovery, manual identification of cathode chemistries, and uncertainties regarding the performance of rejuvenated cathodes in comparison to new cathodes.

- Electro-Chemical Recycling: Electro-chemical recycling utilises electrons for leaching, separation and lithium recovery. Several recycling facilities use bits and pieces of this technology. Ultimately, decarbonization will require a fully decarbonized, electron-driven recycling strategy fuelled by Sun/Wind/Hydro driven electricity-producing technologies combined with decarbonized infrastructure.

- High-temperature processing without smelting: Based on patent filings, Tesla might use thermal reduction of black mass with hydrogen/graphite combined with the Mund’s process to produce battery metal carbonyls–separated by temperature and pressure[1]. These carbonyls will be combined to produce nickel (e.g. LNO) or iron (e.g. LFP) based cathodes.

Challenges and Opportunities in Battery Recycling

While advancements in battery recycling technologies are promising, challenges persist. The industry faces the task of scaling up recycling capacities to meet the increasing volume of end-of-life batteries. Additionally, ensuring the economic viability of recycling operations and addressing environmental concerns related to certain recycling processes are critical hurdles.

- Economic Viability: The economic feasibility of recycling operations is a key concern for OEMs and recyclers alike. High initial capital investments, operational costs, and uncertainties in recycled material prices can impact the profitability of recycling ventures. However, regulatory incentives, advancements in technology, and increasing demand for sustainable practices present opportunities for economic viability.

- Environmental Impacts: Certain recycling processes, especially those involving high-temperature operations with high energy demand or hydro processes producing sodium sulphate solid waste, may have environmental impacts. Developing and adopting cleaner, more environmentally friendly recycling technologies will be pivotal in addressing these issues.

Future Outlook and Recommendations

As the battery recycling landscape continues to evolve, collaboration, innovation, and regulatory compliance will be key drivers for a sustainable and circular battery ecosystem. Industry players must navigate the complexities of recycling technologies and regional policies, recognizing the importance of a holistic approach:

- Collaboration and Innovation: Collaboration between OEMs, recyclers, policymakers, and other stakeholders is crucial for creating a closed-loop system for batteries. Information sharing, research and development partnerships, and joint initiatives can accelerate the development and adoption of advanced recycling technologies. Government grants and the IRA have driven significantly more commercial and pre-commercial activity in the US.

- Regulatory Compliance: Adherence to recycling regulations is imperative for the sustainable growth of the battery recycling industry. Policymakers should continue to refine and update regulations (e.g. EU Battery Regulations) to ensure alignment with technological advancements and evolving industry standards. Simultaneously, OEMs should proactively engage with regulators to contribute to the development of effective and balanced policies. Regulatory compliance cannot be the only economic driver for recycling economics.

- Consumer Awareness: Educating consumers about the importance of battery recycling and sustainable practices is vital. OEMs can play a significant role in raising awareness through marketing campaigns, product labelling, and incentivizing recycling programs. Informed consumers are more likely to actively participate in recycling initiatives, contributing to the overall success of the battery recycling ecosystem. Consumer awareness alone cannot drive battery recycling. In the US and EU, customer awareness is very high, but that has not led to significant commercial battery recycling activity.

Conclusion

The battery recycling landscape is at the forefront of sustainable practices in the automotive and energy sectors. As the global demand for batteries, particularly in electric vehicles, continues to rise, the importance of efficient and environmentally friendly recycling processes cannot be overstated.

Vertical integration among OEMs is a notable trend, providing control over the entire supply chain and enabling compliance with recycling content regulations. However, this approach comes with challenges, particularly the substantial capital investment required, and the complexities associated with managing diverse operations. Striking a balance between the advantages and disadvantages of vertical integration will be crucial for the long-term success of OEMs in the battery recycling space.

The role of recycling policies cannot be ignored, and regions with clear and supportive regulations are likely to witness faster advancements in recycling technologies. As technology continues to evolve, the choice between different recycling methods—hydrometallurgy, pyrometallurgy, direct recycling, and electro-chemical recycling—will depend on factors such as economic viability, environmental impact, and regional policy considerations.

Addressing the economic viability of recycling operations is paramount. While the initial capital investments may be high, regulatory incentives, technological advancements, and growing demand for sustainable practices provide opportunities for profitable recycling ventures. Balancing economic considerations with environmental impacts will be essential for ensuring the long-term sustainability of battery recycling operations.

Looking ahead, collaboration, innovation, and regulatory compliance will be the driving forces in shaping a sustainable and circular battery ecosystem. Industry stakeholders, including OEMs, recyclers, policymakers, and consumers, should collaborate and innovate to build a sustainable future. The battery recycling industry can contribute significantly to the global goal of achieving a sustainable and environmentally responsible energy transition.

Chaitali Agale: is a Product Compliance Analyst with Cummins Inc, USA, for emission and non-emission products, where she works closely to ensure compliance in Zero emissions technology

Mark Lawrence Strauss, PhD Research Engineer/Extractive Metallurgist As a post-doctoral fellow at Idaho National Laboratory, he developed recycling strategies for the processing waste lithium-ion batteries into saleable lithium, copper, manganese cobalt and nickel products. His previous research experience involves the primary and secondary production of critical materials using

Malene Fumany is a Project engineer at WMG, Warwick, working in battery recycling. Her project focuses on Lithium recovery and hydrometallurgical processes

[1] https://patentimages.storage.googleapis.com/3e/60/29/4767a981f26461/WO2022256325A1.pdf