The COVID-19 pandemic has changed mobility. It has also changed the car user’s perception of safety and comfort inside the automotive. As a result, the global car user’s willingness to invest into solutions against invisible germs on interior surfaces and the in-cabin air is growing. This development is one of the key findings of the second Asahi Kasei Europe Automotive Interior Survey conducted in December 2020.

The ongoing COVID-19 pandemic is having a severe impact on mobility. Recent surveys show that the use of public transport and ride sharing services has declined severely. In contrast, the popularity of the private car as a safe space with a low infection risk is increasing. The pandemic will have a lasting effect on existing and future mobility concepts – and on the materials and technologies used inside the automotive.

As the main interface between the user and the car, surface materials are defining how the driver and the passengers perceive the automotive interior and more important: the driving experience itself. In the past the materials needed to be comfortable, attractive to the eye and smooth to the skin. The COVID-19 pandemic is adding a new dimension to this topic, clearly raising the needs towards the overall cleanliness and safety against invisible threats inside the car.

This development was another development confirmed by the second representative “Asahi Kasei Europe Automotive Interior Survey” conducted in December 2020 by Asahi Kasei Europe and the Cologne-based market research institute SKOPOS.

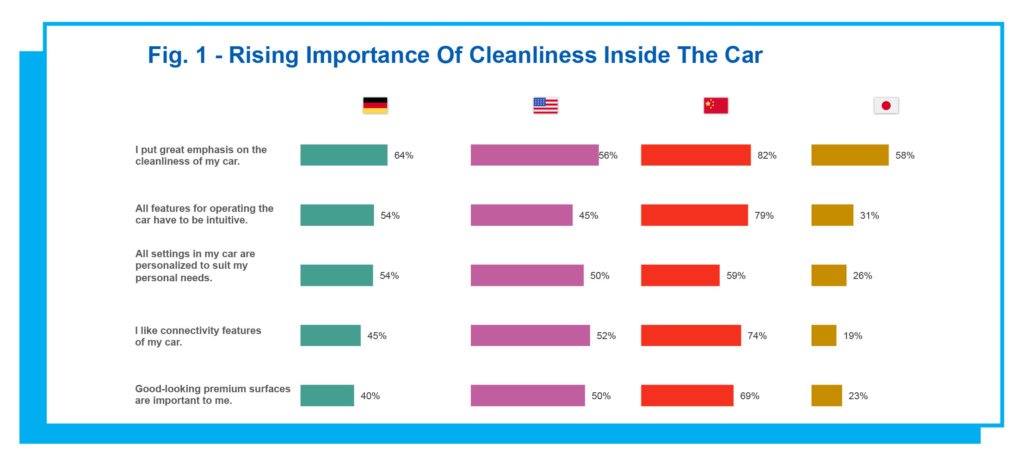

500 vehicle users in each of the global automotive core markets Germany, USA, China and Japan were asked about their preferences in regard to the future automotive interior.

Global car users see benefit in easy-to-maintain surfaces and air filtration systems

One key finding of the survey was the importance of cleanliness inside the car. In Germany, 64% of the car users are putting a great emphasis on this topic, valuing it even higher than connectivity, the intuitive operation or the personalization of the car. The same results can be observed in the other markets: Four out of five car users in China consider cleanliness inside the car as important (see fig. 1).

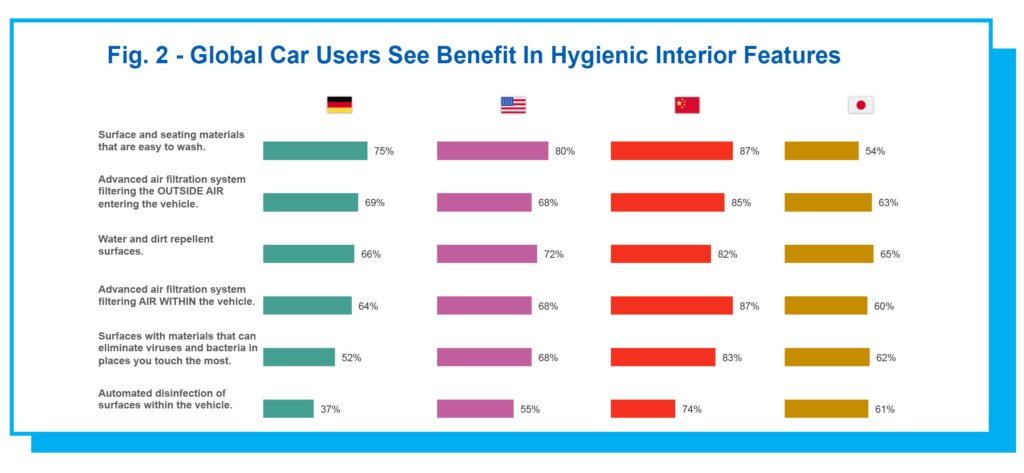

The perception of cleanliness is subjective, but this topic is clearly moving the car users around the world. Premium and lasting interior looks generally climb in importance: Asked about features they would consider beneficial in their next car, 75% of the car users in Germany pointed out “surface and seating materials that are easy to wash”, 66% in “water and dirt repellent surfaces” (see fig. 2). The same features are also of high interest for the car users in the USA and China.

The perception of cleanliness is subjective, but this topic is clearly moving the car users around the world. Premium and lasting interior looks generally climb in importance: Asked about features they would consider beneficial in their next car, 75% of the car users in Germany pointed out “surface and seating materials that are easy to wash”, 66% in “water and dirt repellent surfaces” (see fig. 2). The same features are also of high interest for the car users in the USA and China.

The current pandemic is adding another layer to the car user’s understanding of cleanliness, as it clearly raised the people’s awareness towards the surfaces they touch and the air they breathe – especially in a confined space like a car.

The results of the survey confirm this development: 69% of the German car users see a clear benefit in having an “advanced air filtration system filtering the OUTSIDE AIR entering the vehicle”.

The topic of “clean air” is especially moving the car users in China, with 87% seeing a benefit also in an “advanced air filtration system filtering the AIR WITHIN the vehicle”.

In addition, every second German car user thinks of “Surfaces with materials that can eliminate viruses and bacteria in places you touch the most” as beneficial. In the other three countries this share is even higher.

Heiko Rother, General Manager Business Development Automotive at Asahi Kasei Europe, commented on this development: “The automotive manufacturers are facing the new challenge of taking away the end user’s concerns about invisible threats, making him and her feel safe and comfortable again inside their vehicle. This goes specifically for private cars, but also for all future mobility concepts.”

Willingness to pay for hygienic features

The car user’s accelerating needs towards hygienic features is also reflected in the readiness to pay for solutions for safe surfaces and air inside the car. Every third German car user planning to purchase a new car would be willing to pay an additional 1,000 Euro for a hypothetical, optional “Surface Protect” Package.

In the USA, every second car user agreed to pay 1,000 USD, every fourth even 1,500 USD.

70% of the car users in China would pay 5,000 CNY, every third would be inclined to pay 7,000 CNY, showing a strong acceptance on the Chinese market for additional features that contribute to hygienic surfaces.

A similar trend can be seen in regard to features that contribute to air safety. When purchasing a new car, every third car user in Germany would be inclined to pay 1,000 Euro for a hypothetical, optional “Cabin Protect” * package, ensuring safe air inside the passenger compartment. The same development can be observed in the USA, where about every second car user agrees with paying 1,000 USD, and every fifth even willing to pay 2,000 USD. In China, the demand is clearly higher, with 71% of the car users willing to pay 5,000 CNY, 40% even 7,000 CNY.

Heiko Rother concludes: “The results of the survey show that new solutions against invisible threats are in high demand. With anti-microbial seat covers and plastics, as well as innovative UVC-LED solutions for in-car air filtration, Asahi Kasei is already at the forefront of this development. We are eager to drive this further and continue our effort of teaming up with the industry in contributing to a safer mobility.”

by Sebastian Schmidt, Asahi Kasei Europe

*Cabin Protect Package: A hypothetical, optional package including an automated ventilation system that eliminates microbes and pathogens in cabin air, monitors CO2 levels to reduce drowsiness and provides active occupant sensing for child/pet left behind.

*Surface Protect Package: A hypothetical, optional package with interior materials that provide anti-viral/anti-microbial properties, stain and odour resistance and improved weathering and scratch resistance.